Your credit score may have recently gone up—here's why

August 21, 2018

Last year, major credit reporting companies announced a plan to overhaul how negative information is handled on credit reports. Now, for many consumers, credit scores are going up, in some cases by more than 40 points, according to a report released this week by the New York Federal Reserve.

Your credit score is a measure of how trustworthy you are in the eyes of financial institutions. Scores range from 300 to 850, and a good score, one of 700 or above, can help you qualify for a better interest rate on a loan.

"Payment history – how you have paid your bills in the past — is one of the most important factors in the FICO score. Any negative payment information such as missed payments, public records (e.g. tax liens) and collections can impact the FICO score," Can Arkali, principal scientist for analytics and scores at FICO, tells CNBC Make It.

You may receive a collection account on your report if you default on a loan and fail to make a payment over the span of a few months. "In the past 10 years alone, more than 40 percent of individuals with a credit report had a collections account at some point," the NYFR report states.

But since the overhaul, which was initiated after the Consumer Financial Protection Bureau found problems with credit reporting, firms have stripped tax-lien and civil-judgement data from credit reports, and millions of collection accounts have been removed. A year after the changes were made in June of 2017, 25 percent fewer consumers had a collection account on their credit report.

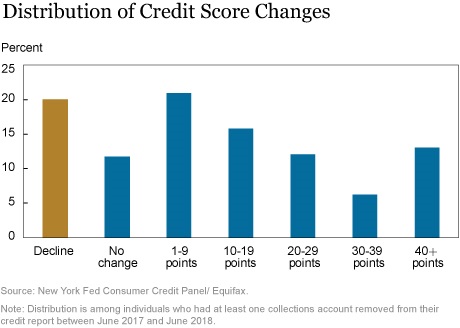

The NYFR findings, which are based on millions of anonymous Equifax credit reports, show how credit scores have changed for people who had at least one collection removed.

The most common impact of the overhaul was a small credit increase of 11 points, but 18 percent saw increases of more than 30 points. People who saw the largest boosts, some of them over 40 points, began with relatively low credit scores.

"If you are starting with a low FICO score, chances are you have other types of negative information on your file and as such, removal of one specific negative item such as a collection would unlikely have a meaningful impact," says Arkali. "On the other hand, if the negative item to be removed is the only negative information on your file, the impact to the FICO score could be more significant."

Close to 20 percent of consumers saw a decrease in credit scores once collections were removed but, according to the report, that's likely because those individuals worsened their scores in other ways.

And around 20 percent of the consumers who had scores below 620 before the overhaul were pushed over that score, a threshold that can be the difference between getting approved or denied for a loan, the Wall Street Journal notes.

Because of the prevalence of reporting errors, FICO recommends double checking your report for inaccuracies that may be hurting your score. "Also keep in mind the recipe to reach and maintain a good FICO score," Arkali says. "Consistently pay your bills on time, reduce the amount of debt you owe as much as possible and apply for credit only when needed."

News Associate

CNBC Make It