HUD Articles

FHA Streamline Refinance: Rates & Requirements for 2021

May 17, 2021

FHA Streamline Refinance: Rates & Requirements for 2021

Dan Green The Mortgage Reports Contributor

The FHA Streamline Refinance

If you currently have an FHA mortgage, the FHA Streamline Refinance is the easiest way to get a lower rate and monthly payment.

The FHA Streamline is a “low-doc” refinance with limited paperwork required. The lender doesn’t have to verify your income or credit, and there’s no home appraisal.

That means a Streamline Refinance closes faster than other loans and has slightly cheaper closing costs.

Thanks to the FHA Streamline, those with FHA loans have easier access to today’s low rates than most homeowners.

Verify your FHA Streamline Refinance eligibility (May 17th, 2021)

In this article:

- What is the FHA Streamline Refinance?

- Today’s FHA Streamline rates

- FHA MIP refund chart

- How the FHA Streamline works

- Are you eligible for an FHA Streamline Refinance?

- Should you use the FHA Streamline?

- What happens to FHA mortgage insurance when I refinance?

- FHA MIP cancellation policy

- Streamline Refinance FAQ

What is the FHA Streamline Refinance?

The FHA Streamline is a special refinance product, reserved for homeowners with existing FHA mortgages. An FHA Streamline is the fastest, simplest way for FHA-insured homeowners to refinance their mortgages into today’s low mortgage rates.

Benefits of the FHA Streamline program include:

- Low refinance rates — FHA loan rates currently average 2.625% (3.604% APR). This is an incredibly low rate compared to most of the mortgage industry

- Lower MIP rates — If you got an FHA loan between 2010 and 2015, you may be able to lower your annual mortgage insurance premium using FHA streamline refinancing

- MIP refund — Homeowners who use the FHA Streamline Refinance may be refunded up to 68 percent of their prepaid mortgage insurance, in the form of an MIP discount on the new loan

- No appraisal — You can use the FHA Streamline Refinance even if your current mortgage is underwater

- No verification of job or income — You may be eligible for FHA Streamline refinancing even if you recently lost your job or took a pay cut

- No credit check — A low credit score won’t stop you from using the FHA Streamline program. This is almost impossible to find with other refinance loans

If you have an existing FHA loan and you want to refinance into a lower interest rate, the FHA Streamline should be your first stop.

Its benefits are nearly unmatched by any other refinance option.

Verify your FHA Streamline Refinance eligibility (May 17th, 2021)

FHA Streamline Refinance Rates

Today’s average 30-year FHA rate is 2.625% (3.604% APR). But remember, the FHA mortgage insurance fee adds 0.85% in annual costs. This also applies to Streamline refinances.

If you’re considering an FHA Streamline Refinance, now is a good time to lock in a low base rate and see bigger savings over the life of your loan.

Shop low FHA Streamline Refinance rates here (May 17th, 2021)

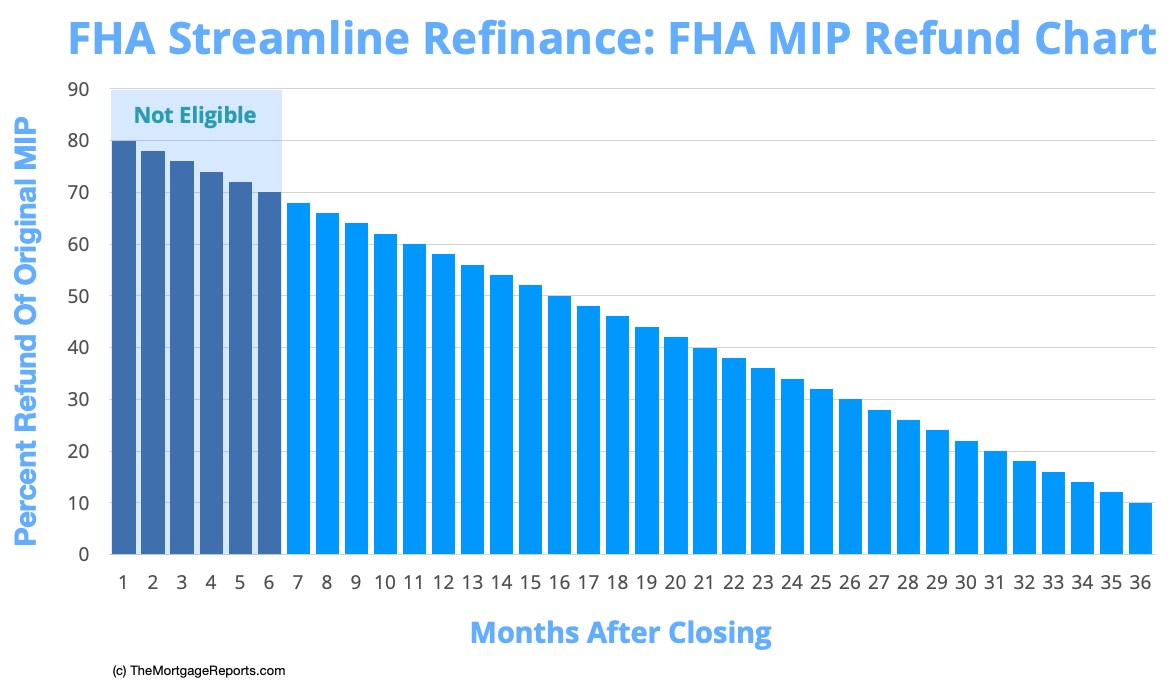

FHA MIP refund chart

There’s an additional benefit for FHA-backed homeowners refinancing within the first three years of their existing loan origination.

The FHA provides a partial refund on your previously-paid upfront mortgage insurance premium (UFMIP).

The size of the refund diminishes as the three-year window elapses.

For example, a homeowner who refinances an FHA mortgage after 11 months is granted a 60 percent refund on their initial FHA UFMIP.

Thirty days later, the refund drops to 58 percent. After another 30 days, it drops to 56 percent, and so on.

| Months After Closing | MIP Refund | Months After Closing | MIP Refund | Months After Closing | MIP Refund |

| 7 | 68% | 17 | 48% | 27 | 28% |

| 8 | 66% | 18 | 46% | 28 | 26% |

| 9 | 64% | 19 | 44% | 29 | 24% |

| 10 | 62% | 20 | 42% | 30 | 22% |

| 11 | 60% | 21 | 40% | 31 | 20% |

| 12 | 58% | 22 | 38% | 32 | 18% |

| 13 | 56% | 23 | 36% | 33 | 16% |

| 14 | 54% | 24 | 34% | 34 | 14% |

| 15 | 52% | 25 | 32% | 35 | 12% |

| 16 | 50% | 26 | 30% | 36 | 10% |

Note: FHA homeowners are only eligible for the Streamline Refinance program after six months. Thus, eligibility for an MIP refund starts at seven months.

This is why it’s rarely a good idea to “wait to refinance” an FHA loan.

With the FHA Streamline Refinance program, the sooner you refinance, the bigger your refund, and the lower your total loan size for your new mortgage.

This lowers the monthly payment and preserves the home equity — two huge positives.

Check your Streamline Refinance eligibility (May 17th, 2021)

How the FHA streamline works

For the most part, the FHA Streamline works like any other refinance program.

It’s available as a fixed-rate or adjustable-rate mortgage; it comes with a 15- or 30-year term; and there’s no FHA prepayment penalty to worry about.

Note, the FHA Streamline cannot be used to refinance a 30-year mortgage into a 15-year mortgage.

It can, however, be used to extend a 15-year loan into a 30-year loan. Doing this lowers monthly payments even further for homeowners.

Another big plus is that rates for the FHA Streamline Refinance are the same as mortgage rates for a homebuyer’s FHA loan. There’s no penalty for being underwater, or for having very little equity.

No home appraisal

The biggest difference between the FHA Streamline and most traditional mortgage refinance options is that the FHA Streamline doesn’t require a home appraisal.

Instead, the FHA will allow you to use your original purchase price as your home’s current value, regardless of what your home is actually worth today.

Since the FHA Streamline Refinance does not require an appraisal, you can refinance into a lower interest rate even if you owe more on your loan than the home is currently worth.

In this way, with its FHA Streamline Refinance program, the FHA does not care if you are underwater on your mortgage.

Rather, the program encourages underwater refinancing.

Even if you owed twice what your home is now worth, FHA may allow you to refinance your home without added cost or penalty.

The “appraisal waiver” has been a huge hit with U.S. homeowners, allowing unlimited loan-to-value (LTV) home loans via the FHA Streamline Refinance program.

Check your underwater refinance eligibility (May 17th, 2021)

Reduced documentation

Another big plus: It’s fairly easy for this refinance.

The FHA Streamline Refinance does not require most of the typical verifications you’d need to get a new mortgage.

As it’s written in the FHA’s official mortgage guidelines:

- Employment verification is not required with an FHA Streamline Refinance

- Income verification is not required with an FHA Streamline Refinance

- Credit score verification is not required with an FHA Streamline Refinance (though most lenders will check credit)

When you put it all together, you can be (1) out-of-work, (2) without income, (3) have shaky credit report, and (4) have no home equity. Yet, you could still be approved for an FHA Streamline Refinance.

That’s not as crazy as it sounds, by the way.

To understand why the FHA Streamline Refinance is a smart program for the FHA, we have to remember the FHA’s chief role is to insure mortgages — not “make” them.

It’s in the FHA’s best interest to help as many people as possible qualify for today’s low mortgage rates. Lower mortgage rates means lower monthly payments which, in theory, leads to fewer loan defaults.

This is good for homeowners who want lower mortgage rates, and it’s good for the FHA. With fewer loan defaults, the FHA has to pay fewer insurance claims to lenders.

Check today's FHA Streamline Refinance rates today (May 17th, 2021)

Are you eligible for an FHA Streamline Refinance?

Although the FHA Streamline Refinance bypasses “traditional” mortgage standards, like income verification and credit qualifying, the program does enforce minimum standards for applicants.

You’ll need to show:

- Three months of on-time mortgage payments

- At least 210 days since your home purchase or last refinance

- A clear monetary benefit to refinancing

- That you can lower your interest rate by at least 0.50% in most cases

The official FHA Streamline Refinance guidelines are below. Note that not all mortgage lenders will underwrite to the official guidelines of the Federal Housing Administration.

Some lenders might enforce credit score minimums or other underwriting standards for FHA Streamline mortgages.

If your current lender is requiring a home appraisal or income verification, you’re free to shop around for a more lenient lender that adheres to the FHA’s minimal guidelines for Streamline refinancing.

Verify your FHA Streamline eligibility (May 17th, 2021)

Perfect, 3-month payment history is required

The FHA’s main goal is to reduce its overall loan pool risk. Therefore, it’s number one qualification standard is that homeowners using the Streamline Refinance program must have a perfect payment history stretching back at least three months.

Homeowners with 30-day, 60-day, and 90-day late payments are not allowed to use this refinancing option.

One mortgage late payment is allowed in the last 12 months. Loans must be current at the time of closing.

210-day “waiting period” after buying or refinancing

The FHA requires that borrowers make six mortgage payments on their current FHA-insured loan, and that 210 days pass from the most recent closing date, in order to be eligible for a Streamline Refinance.

The refinance must have “purpose”

Streamline Refinance applicants must demonstrate a ‘Net Tangible Benefit’ from the refinance — meaning there will be a clear monetary benefit to the new loan.

Loosely, Net Tangible Benefit is defined as reducing the “combined rate” by at least one-half of one percent.

For instance, say a homeowner has an FHA loan opened in May 2013 with a rate of 5.00%, and an annual mortgage insurance premium equal to 1.35 percent of the mortgage amount.

The combined rate is 6.35 percent.

The homeowner looks into a Streamline Refinance, and receives a rate quote at 4.75% with MIP of 0.85 percent. They save on their rate and mortgage insurance, since FHA MIP was reduced in January 2015.

The new combined rate would be 5.60 percent, or three-quarters of one percent lower than the existing combined rate. This FHA refinance would be eligible.

Another allowable Net Tangible Benefit is to refinance from an adjustable-rate mortgage to a fixed-rate mortgage.

This is considered a benefit because fixed-rate mortgages have predictable rates and payments that carry less risk of default.

Taking “cash out” to pay bills is not an allowable Net Tangible Benefit.

Check your FHA Streamline Refinance eligibility (May 17th, 2021)

Employment and income are not verified

The FHA does not require verification of a borrower’s employment or annual income as part of the FHA Streamline process.

There is no Verification of Employment, nor are there paystubs, W-2s or tax returns required for approval.

You can be unemployed and get approved for an FHA Streamline Refinance so long as you still meet the other program requirements.

Credit scores are not verified

The FHA does not verify credit scores as part of the FHA Streamline Refinance program. Instead, it uses payment history as a gauge for future loan performance.

This means that FICO scores below 640, below 620, below 580, and even below 500 could be eligible for Streamline Refis.

Some lenders, however, create their own minimum requirements. Check your lender’s credit qualifying guidelines before applying.

Click here to verify your FHA rate reduction (May 17th, 2021)

Loan balances may not increase to cover loan costs

The FHA prohibits increasing a Streamline Refinance’s loan balance to cover associated loan charges, like closing costs.

The mortgage amount is limited by the math formula of (Current Principal Balance + Upfront Mortgage Insurance Premium).

All other costs — including origination charges, title charges, and prepaid taxes and insurance — must be either (1) Paid by the borrower as cash at closing, or (2) Credited by the loan officer in full.

The latter is called a “no-cost FHA Streamline.”

No cash-out

You can’t take extra cash out when refinancing with an FHA Streamline loan. This refinance is designed mainly to lower the homeowner’s interest rate and payment.

However, the FHA cash-out refinance is another refinancing option offered by the FHA.

It allows you to open a loan of up to 80 percent of your home’s value. If that amount is larger than your current loan balance, you take the difference in cash.

Homeowners can use these funds for any purpose: to pay off debt, improve your home, or create an emergency fund.

Appraisals not required

The FHA isn’t concerned about home value — it’s insuring your loan regardless.

Therefore, the FHA does not require appraisals for its Streamline Refinance program. Instead, it uses the original purchase price of your home, or the most recent appraised value, as its valuation point.

Homes that are underwater are still FHA Streamline-eligible.

Should you use the FHA Streamline?

What happens to FHA mortgage insurance if you Streamline Refinance?

Like other FHA loans, the FHA Streamline Refinance requires borrowers to pay mortgage insurance.

Even if you’ve built equity in the home since purchasing it, the FHA Streamline Refinance cannot be used to eliminate mortgage insurance premium (MIP).

FHA borrowers are required to make two types of mortgage insurance payments: an upfront mortgage insurance payment paid at closing, plus an annual payment split into 12 installments, which are paid with your mortgage each month.

- Upfront Mortgage Insurance Premium (UFMIP) = 1.75% of the loan amount for most recent FHA loans and refinances

- Annual Mortgage Insurance Premium (MIP) = 0.85% of the loan amount most recent FHA loans and refinances

With respect to mortgage insurance premiums, homeowners using the FHA Streamline Refinance program are split into two classes:

- Homeowners whose new loan replaces an FHA-backed mortgage endorsed prior to June 1, 2009

- Homeowners whose new loan replaces an FHA-backed mortgage endorsed on/after June 1, 2009.

Homeowners in the first class -— those with “old” FHA mortgages — are assigned different mortgage insurance than newer FHA homeowners.

Specifically, these older FHA mortgages qualify for a reduced upfront premium of just 0.01% of the loan amount, or $10 for every $100,000 borrowed.

Additionally, monthly mortgage insurance is just 0.55 percent of the loan amount annually, compared to “regular” MIP of 0.85 percent per year.

FHA Streamline MIP For Loans Endorsed On/After June 1, 2009

If you are refinancing an FHA mortgage via the FHA Streamline Refinance program and your existing FHA mortgage was endorsed on, or after, June 1, 2009, your mortgage insurance premium schedule on your new FHA loan is as follows.

Upfront Mortgage Insurance Premiums (UFMIP)

For an FHA Streamline Refinance replacing a loan endorsed on, or after, June 1, 2009, the FHA upfront mortgage insurance premium is equal to 1.75 percent of your loan size, or 175 basis points.

This is $1,750 for every $100,000 borrowed. The FHA automatically adds the $1,750 premium to your loan balance for you — it’s not paid as cash.

However, not all refinancing households will pay the full amount.

As shown in the chart above, those using an FHA Streamline within three years of their original loan stand to get an upfront MIP refund.

This can significantly lower the amount of UFMIP added to your new loan, thus reducing the amount you have to pay overall.

Annual Mortgage Insurance Premiums (MIP)

The annual MIP schedule for an FHA Streamline Refinance which replaces a loan from on, or after, June 1, 2009 is as follows :

- 15- & 30-year loan terms with an LTV over 90 percent: 0.85% annual MIP, payable for the life of the loan

- 15- & 30-year loan terms with an LTV under 90 percent: 0.85% annual MIP, payable for 11 years

Note that these MIP costs may be lower than what you’re paying on your existing FHA home loan.

In January 2015, the FHA lowered its mortgage insurance premiums on 30-year loans, making it less expensive to carry an FHA home.

If your current FHA MIP is higher than what’s shown above, consider starting a refinance immediately to benefit from a new, lower FHA MIP.

FHA Streamline Refinance MIP (For Loans Endorsed Before June 1, 2009)

If your existing FHA home loan was endorsed prior to June 1, 2009, your mortgage insurance premiums have been “grandfathered.”

You can refinance via the FHA Streamline Refinance program and pay reduced rates for both your upfront and annual mortgage insurance premium.

Upfront Mortgage Insurance Premiums (UFMIP)

For an FHA Streamline Refinance that replaces a loan endorsed prior to June 1, 2009, the new FHA mortgage’s upfront mortgage insurance is equal to 0.01 percent of the loan size, or 1 basis point.

For example, if your new FHA Streamline Refinance is for $100,000, the FHA will assess a $10 upfront mortgage insurance premium (MIP) to be paid at closing.

The FHA automatically adds the $10 payment to your new loan balance.

Annual Mortgage Insurance Premiums (MIP)

Annual MIP is similarly cheap for older FHA loans. For an FHA Streamline Refinance replacing an FHA loan endorsed prior to June 1, 2009, the annual MIP is 0.55 percent annually, or 55 basis points.

The complete annual MIP schedule is as follows:

- 15- & 30-year loan terms with an LTV over 90 percent: 0.55% annual MIP, payable for the life of the loan

- 15- & 30-year loan terms with an LTV under 90 percent: 0.55% annual MIP, payable for 11 years

FHA MIP Cancellation Policy

The FHA requires some homeowners to pay mortgage insurance for as long as their loan is in effect.

If your FHA Streamline Refinance replaces a loan from on, or after, June 1, 2009, the rules on your FHA MIP cancellation are as follows:

- LTV of 90 percent or less at the time of closing: MIP is required for 11 years

- LTV greater than 90 percent at the time of closing: MIP required for the life of the loan

The FHA MIP cancelation policy applies to 15-year loan terms and 30-year loan terms equally.

Note that refinancing homeowners are welcome to bring cash to closing in order to reduce their loan balance and change their MIP disposition. However, not everyone will have the cash to make such a move.

This is why, when exploring an FHA Streamline Refinance, you should also look at other mortgage refinance options including the conventional mortgage loan via Fannie Mae or Freddie Mac, which is available with nearly every mortgage lender.

The FHA allows its homeowners to refinance to a conventional loan to cancel FHA MIP.

FHA Streamline Refinance FAQ

What is the FHA Streamline program?

FHA Streamline is a refinance program that only current FHA homeowners can use. It’s faster and easier than most refinance programs, with no documentation required for income, credit, or home appraisal.

An FHA Streamline Refinance can help homeowners lower their annual mortgage insurance premium (MIP) or even get a partial refund of their upfront MIP payment.

How does the FHA Streamline Refinance work?

The FHA Streamline Refinance resets your mortgage with a lower interest rate and monthly payment. If you have a 30-year FHA mortgage, you can use the FHA Streamline to refinance into a cheaper 30-year loan. 15-year FHA borrowers can refinance into a 15- or 30-year loan.

The FHA Streamline does not cancel mortgage insurance premium (MIP) for those who pay it. But annual MIP rates may go down, depending on when the loan was originated.

Do I have to pay closing costs on an FHA Streamline Refinance?

The borrower has to pay closing costs on an FHA Streamline Refinance. Unlike other types of refinances, you cannot roll these costs into your loan amount.

FHA Streamline closing costs are typically the same as other mortgages: 2 to 5 percent of the mortgage amount, which would equal $3,000 to $7,500 on a $150,000 loan. The difference is, you don’t have to pay for an appraisal on an FHA Streamline, which could save about $500 to $1,000 in closing costs.

Does an FHA Streamline Refinance get rid of PMI?

No, the FHA Streamline Refinance does not eliminate mortgage insurance. Refinanced FHA loans still have annual mortgage insurance, as well as a new upfront mortgage insurance fee equal to 1.75 percent of the loan amount. The upfront fee is added to your loan amount.

However, if you use the FHA Streamline Refinance within three years of opening your loan, you’ll be refunded part of your original UFMIP fee — thus lowering the total mortgage amount.

Do I qualify for an FHA Streamline Refinance?

To qualify for an FHA Streamline Refinance, your current home loan must be insured by the FHA. If you’re not sure whether it is, ask your lender.

FHA also requires three months of on-time payments, and a 210-day waiting period since your home’s last closing date (either purchase or refinance). Finally, the FHA Streamline Refinance must have a “purpose.” That usually means the refinance needs to lower your combined interest and insurance rate by at least 0.50%.

Does FHA Streamline require a credit check?

Technically, the FHA Streamline does not require a credit check. That means homeowners could potentially use the Streamline Refinance even if their credit score has fallen below the 580 threshold for FHA loans. However, some lenders may check your credit report anyway. So if your credit is on the lower end, be sure to shop around.

Can you cash out on an FHA Streamline?

No, you cannot take cash out on an FHA Streamline Refinance.

What documents do I need for an FHA Streamline Refinance?

The FHA Streamline Refinance is a “low-doc” refinance loan; it requires less paperwork than most other mortgages. But there’s still some documentation required. For an FHA Streamline Refinance, you’ll still need:

– A loan application

– A current mortgage statement showing a six month payment history

– Contact information for your employer (the lender may verify employment, but not income)

– Two months’ worth of bank statements showing you can cover out-of-pocket closing costs

– Utility bills showing you use the home as a primary residence

When can I do an FHA Streamline Refinance?

FHA homeowners are eligible for a Streamline Refinance 210 days after their last closing. That means you must have made six consecutive mortgage payments since you purchased or last refinanced the home.

Can you do FHA Streamline Refinance twice?

Yes, you can use the FHA Streamline Refinance more than once. You just need to meet FHA’s guidelines — meaning it’s been at least 210 days since your last refinance, you’ve made your last three payments on time, and you can lower your rate around 0.50%.

What are the benefits of an FHA Streamline?

The big benefit of an FHA Streamline Refinance is that you can switch your FHA loan to a lower rate and monthly payment. You can save money by getting rid of your existing higher interest rate without as much hassle as traditional refinancing options.

Another benefit of the FHA Streamline is that there’s no home appraisal – so you can refinance into a lower FHA mortgage rate even if you have very little equity or your loan is underwater.

Is FHA Streamline Refinance worth it?

The FHA Streamline Refinance is probably worth it if you can lower your mortgage rate and monthly payment a significant amount. It’s an especially good deal for homeowners who purchased or refinanced from 2010 to 2015, because FHA has since lowered its annual mortgage insurance rates.

By refinancing a pre-2015 mortgage with the FHA streamline, you may be able to drop your annual mortgage insurance rate from over 1 percent to just 0.85 percent.

How do I get rid of PMI on an FHA loan?

FHA mortgage insurance premium (MIP) lasts 11 years if you made a down payment of 10 percent or more, or the full life of the loan if your down payment was less than 10 percent.

The only way to get rid of FHA mortgage insurance is my refinancing your current FHA loan into a conventional loan without PMI.

To do this, you’ll need at least 20 percent equity in your home and a credit score of at least 620 or higher. You’ll also need to pay closing costs and complete the new loan’s underwriting process.

What are today’s FHA Streamline rates?

FHA mortgage rates are low and homeowners typically close in less than 30 days. Remember: the faster you close, the bigger your FHA MIP refund.

Get started by checking today’s FHA refinance rates to see what you could save.